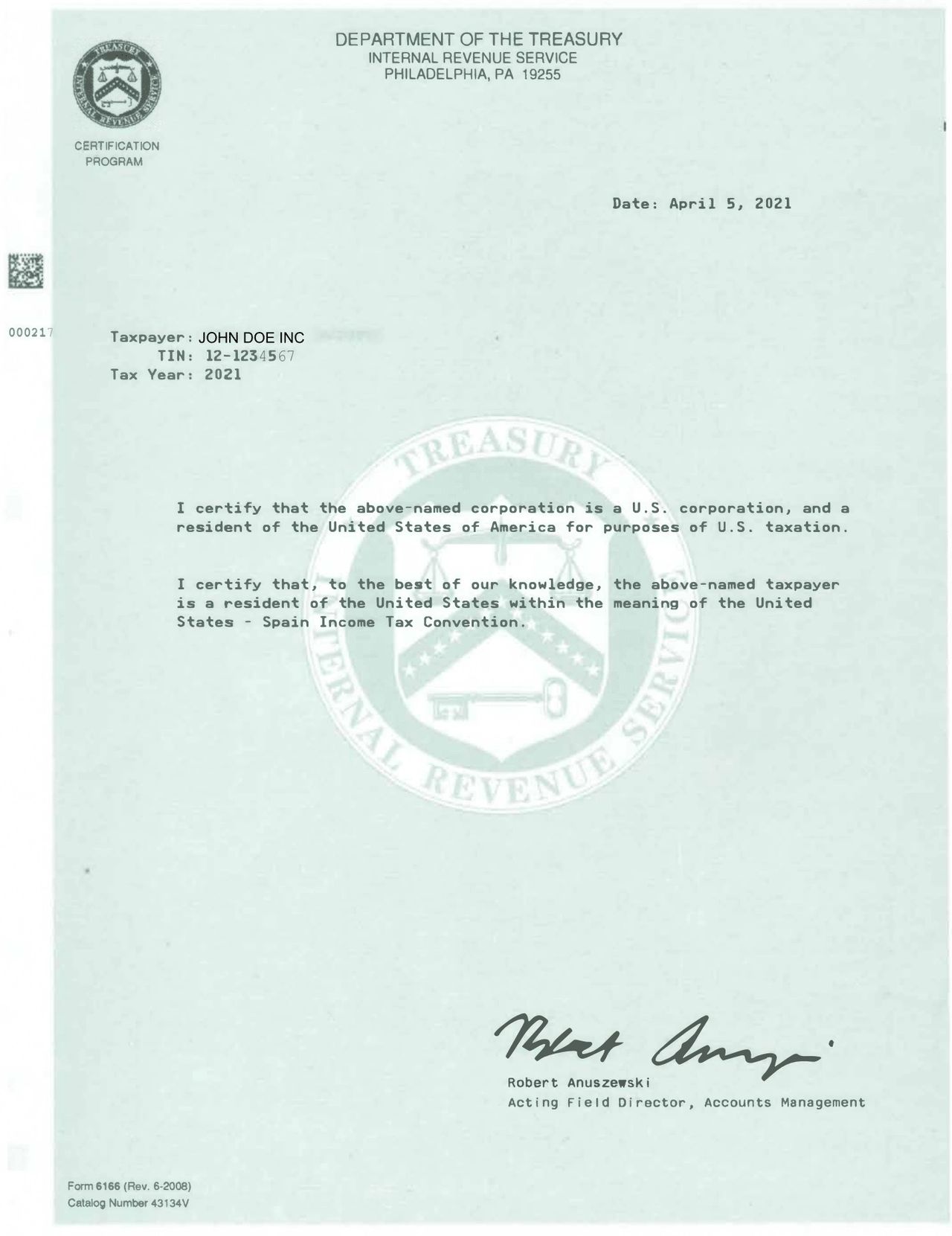

You may send estimated tax payments with form 1040-es by mail (postmarked by the due date), pay online , by phone, or from your mobile device using the irs2go app. If paying by check, taxpayers should be sure to make the check payable to the "united states treasury. "the best way to make a payment is through the irs online account, according to the irs. There taxpayers can see their payment history, any pending payments and other useful tax information. Taxpayers can make an estimated tax payment by using irs direct pay ; debit card, credit card or digital wallet ;or the treasury department's electronic federal tax payment system (eftps). Are you an american living in another country who’s not sure how to pay united states expat taxes? you’re far from alone — in fact, many don’t even know whether or not they need to file taxes. Unfortunately, for those who do need to, filing taxes from abroad is often more complex than filing them from within the us. For one, expats must often claim exemptions or credits to avoid double taxation. On top of that, they may also have to report foreign -registered businesses, bank accounts,

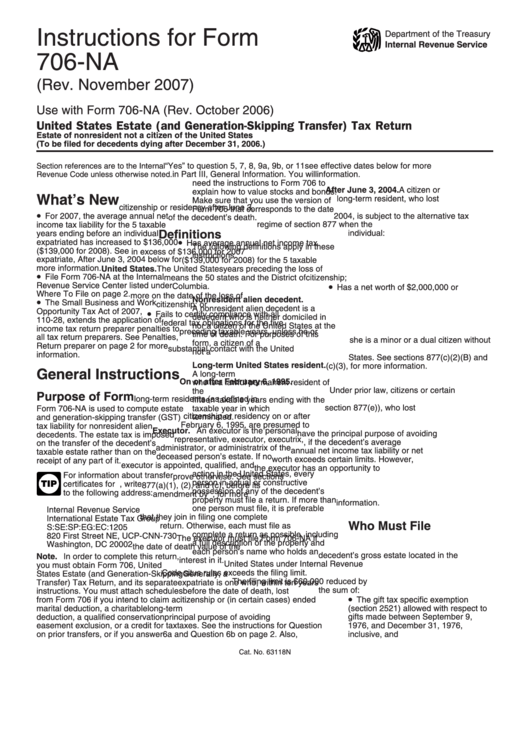

Contributed by marini & associates, p. A. , usa for those of you whose practice involves international tax, i would like to take this opportunity to explain the deceptive simplicity of the form 706 na. You must have a client who is a nonresident alien who dies. He/she owns us situs assets so you look at section 2014 of the internal revenue code; you correctly determine that since these assets exceed $60,000 in value, the estate is required to file a form 706na which is the form analogous to a 706 in the hands of a nonresident alien. The form itself is deceptively simple-two pages-what kind of problems can this create? once you start reading the form, you realize that to complete it properly, you may have to incorporate almost every schedule which appears in a 706. The executor must file form 706-na if at the date of death, the value of the decedent’s u. S. -situated assets, together with the gift tax specific exemption and the amount of adjusted taxable gifts, exceeds the filing threshold of $60,000. http://x4a.s3-website.eu-west-1.amazonaws.com/TaxTalk/tax/Form-706-NA-Explained-Key-Considerations-and-Requirements-for-Nonresident-Alien-Estate-Tax-Filings.html How to File Form 706-NA § 20. 6018-1 returns. (a) estates of citizens or residents. A return

If you are a US expat working in UAE , you may have a variety of tax concerns. From figuring out how much foreign income you should report, to understanding what tax breaks are available in your host country, it can be overwhelming! Fortunately, the IRS has made it easy for expats to exclude up to $112,200 of earned income in 2022 and 2022.3 This is the Foreign Earned Income Exclusion or FEIE. It is a great way to reduce or eliminate your U.S. taxes on earnings abroad. Expatriation Expats, Americans who move to a foreign country to live and work, are subject to US taxation of their foreign income. They must file a US tax return each year reporting their income from abroad, and they must also file FinCEN Form 114 to report any assets in foreign bank accounts that exceed $10,000. Many expats can take advantage of certain US tax benefits, exclusions, and deductions to reduce or eliminate their US tax bills. For instance, expats can exclude up to $112,000 of their 2022 foreign earnings from their US taxes using the Foreign Earned Income Exclusion (FEIE). Another popular tax benefit for expatriates is

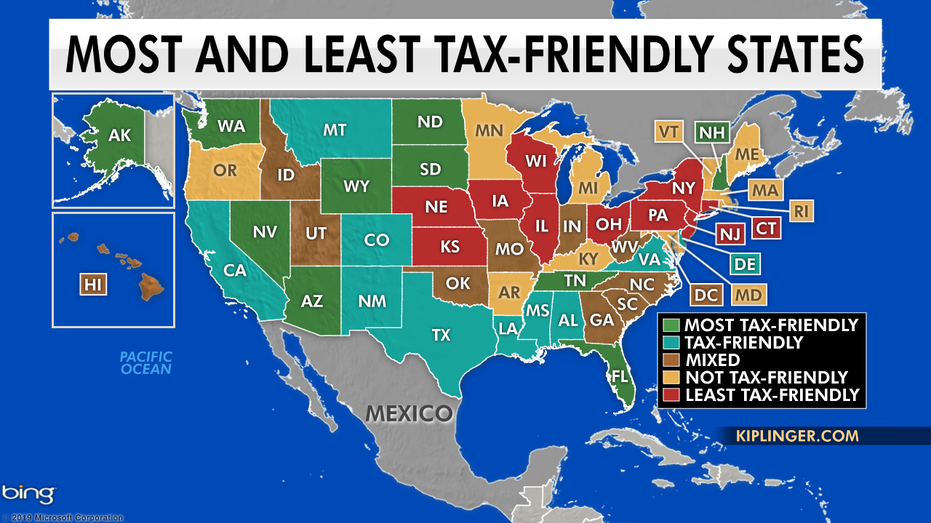

All US citizens, US permanent residents (green card holders), and people who meet the substantial presence test for a calendar year are considered tax residents. This is important to know because the IRS taxes income earned anywhere in the world, irrespective of where it was received. Understanding your status can help you understand how to maximize your tax benefit. 1. Domicile Domicile is one of the key elements in determining your status as a US tax resident and it's something that can have major implications for your tax and estate affairs. It's important to understand this distinction so that you can make an informed decision as to where you want to live and what your financial situation will be once you've moved there. There are many factors to consider when determining your domicile and each of them can have an impact on the outcome of your case. The best way to determine your domicile is to seek expert advice from a reputable wealth manager. Your domicile is also likely to have an effect on your estate and gift tax obligations. In the event of your death, a tax examiner will typically use your state of

There is a lot of miss-information on the subject of the us tax laws regarding us citizens and other us taxpayers. This book is a complete guide to us tax laws relating to this issue. Included is a simplified overview, comprehensive details on the various issues, deductions, credits and income exclusions as it is related to us taxpayers living abroad. It is very important that expats understand that there is no automatic deductions, credits or exclusions a us tax return must be filed and necessary auxiliary forms filled out properly to take advantage of these deductions, credits and exclusions. With clients in dozens of countries, we work with many us exposed persons who need reliable us expat tax services. We work exclusively with higher income earners and enjoy those with unusual or complex situations. We are not a tax return treadmill with a team that turns around thousands of simple returns each month. Relationships are important as our clients are international entrepreneurs, location independent professionals, c suite executives and fund managers. Any us citizen, green card holder, or a long-term visitor must file a us tax return. However, the sound advice of a us expat tax professional ,