Tax Residency: How to Determine Your Status and Why It Matters for US Taxation

All US citizens, US permanent residents (green card holders), and people who meet the substantial presence test for a calendar year are considered tax residents.

This is important to know because the IRS taxes income earned anywhere in the world, irrespective of where it was received. Understanding your status can help you understand how to maximize your tax benefit.

1. Domicile

Domicile is one of the key elements in determining your status as a US tax resident and it's something that can have major implications for your tax and estate affairs. It's important to understand this distinction so that you can make an informed decision as to where you want to live and what your financial situation will be once you've moved there.

There are many factors to consider when determining your domicile and each of them can have an impact on the outcome of your case. The best way to determine your domicile is to seek expert advice from a reputable wealth manager.

Your domicile is also likely to have an effect on your estate and gift tax obligations. In the event of your death, a tax examiner will typically use your state of domicile to make a decision as to where your estate should be transferred and how much tax you should pay.

If you have changed your state of domicile, it is essential to ensure that all of the relevant documentation relating to your residence in the new state is updated as soon as possible. This should include your car registration, driver's license, Social Security records, credit cards, bank accounts and any other documents that are linked to your home address.

It is also advisable to register for a new driver's licence and change all of the addresses that you use as a matter of course. This will help to prevent double taxation by the states that you are residing in.

Proving that you have moved to a new state with the intention of making it your permanent home is the most difficult aspect of establishing a change of domicile. This requires a thorough examination of an individual's lifestyle, habits and other details of their life.

This is a subjective and unpredictable determination that relies on the intent of the individual and must be made on a case by case basis. For this reason, a change of domicile is often accompanied by an analysis of other factors that are important to the individual's financial well-being, such as their investments and spending habits.

2. Substantial Presence

The IRS uses a unique test to determine whether someone should be considered a US tax resident for income tax purposes: the substantial presence test. This test determines how many days a person must be physically present in the United States during the year to qualify for resident status.

Under the substantial presence test, an individual must be physically present in the United States for at least 31 days during the current year and 183 days during the previous two years. However, the number of days that count towards your substantial presence is determined using a mathematical formula, which is more complex than simply counting the number of days that you were in the US.

Generally speaking, the substantial presence test applies to individuals who are not US citizens or lawful permanent residents. These individuals include foreign government-related employees, teachers and students temporarily in the United States, and professional athletes under J-1 non-student immigration status.

It’s also important to note that some exemptions can make the substantial presence test more complicated than it otherwise may be. For example, the IRS will exclude days of commuting from Mexico or Canada to the United States, and days spent in transit between countries.

This is especially important for those who live in one country and commute to work in another. These days do not count toward your total, but you still need to keep track of how many days you’ve been in the United States to be sure that you’re avoiding the substantial presence test.

In addition to these exceptions, the substantial presence test does not apply to certain foreign national employees who meet a special green card test. If the Immigration and Naturalization Service issues the green card, the employee will be treated as a resident for U.S. taxes even if they’re not physically present in the United States during the tax year.

The green card test is a bit more complicated than the substantial presence test, but it can be a good option for nonresident foreign national employees who have a closer connection to a foreign country than they do to the U.S. If you’re not sure whether your foreign national employee will qualify under the green card test, consult with a professional for help.

3. Sources of Income

Tax Residency

One of the most important factors in determining your status as a US resident for tax purposes is your source of income. This is especially true for individuals who work and live in the same state as their employer. However, it also applies to residents of other states who receive income from non-US-sourced sources.

The IRS uses a combination of three criteria to determine your residency. The first is your legal domicile. This means that you have a legal home in the country and have been residing there for at least 183 days.

Another criteria is your substantial presence. This is a more stringent test than your domicile and can be applied to people who live in other countries or travel to different parts of the United States. This requires that you have a permanent residence or green card.

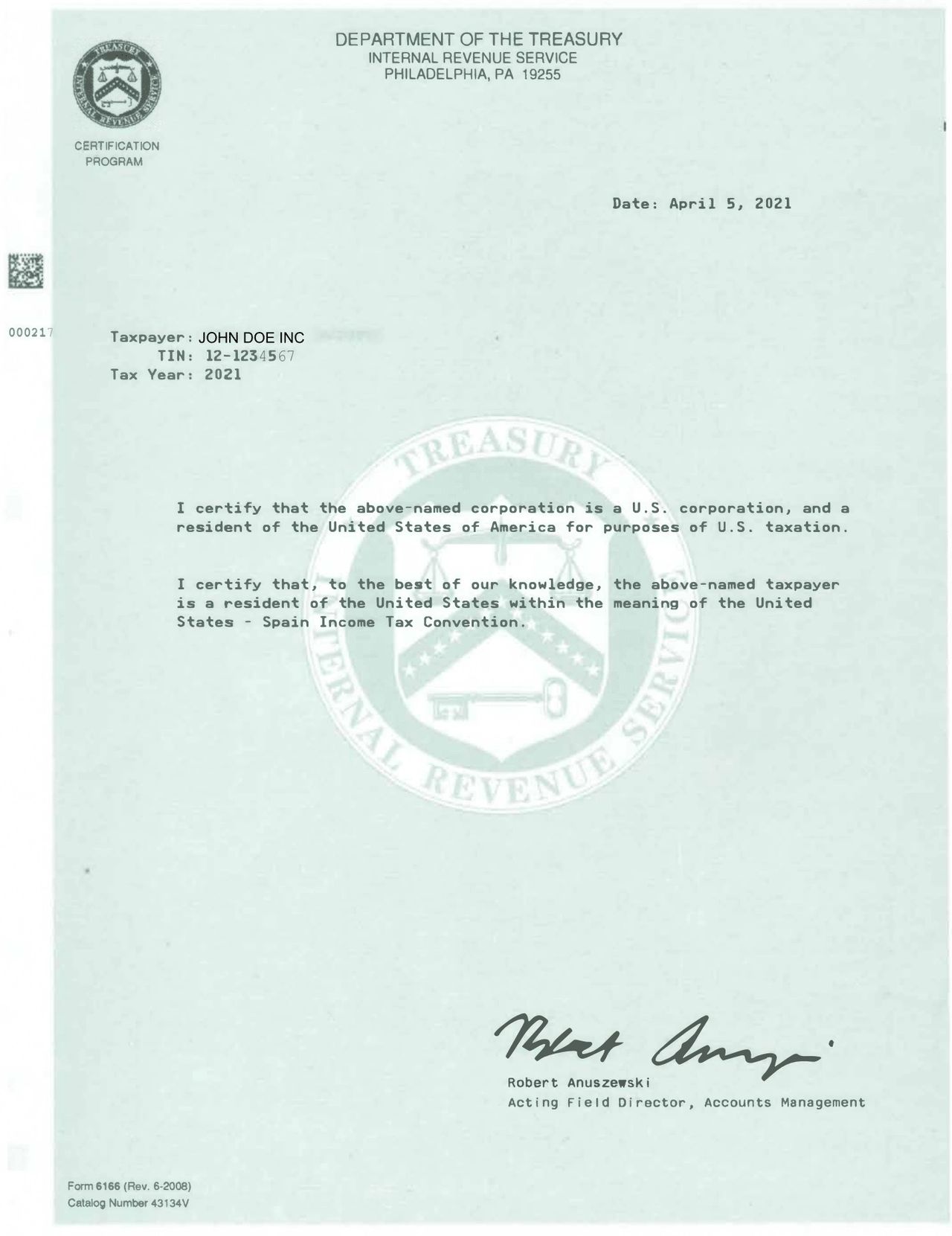

If you meet these tests, you will be considered a U.S. resident for tax purposes and will file a Form 1040.

You may be able to claim a tax credit for your income taxes instead of paying them. These credits reduce your taxes dollar for dollar. They are often designed to encourage certain behaviors that benefit the economy, the environment or a specific cause.

For example, there are education-related tax credits that can help you pay for school and other related expenses. There are also tax incentives for buying energy-efficient appliances and making other energy improvements.

These credits aren't deductions, but they do lower your taxable income and have requirements that you must satisfy before they can be claimed. They can be nonrefundable, refundable or partially refundable.

In addition to reducing your income tax liability, these tax credits can also help you save money on things like medical insurance premiums or other expenses. They can be used to offset your federal and state income taxes.

You can also claim a tax treaty benefit for your foreign-earned income if you meet the physical presence test and paid taxes in that country. This benefit can be worth as much as $108,700 in 2021.

4. Dual Status

If you are a non-US citizen and spend part of a year in the US, you will need to file a dual status tax return. The IRS defines a dual-status alien as a non-US citizen who is a resident for a portion of the year and a non-resident for the rest.

There are a few different ways to determine your status as a tax resident. One of the most common ways is to look at where you spent the majority of the year. If you have spent more time in the US, you’ll probably be treated as a U.S. citizen and will be required to file a US tax return.

Another way to determine your status is to consider if you have been treated as a non-US person for any part of the year. If so, you’ll have to file a dual-status tax return with two forms: Form 1040 for your resident income and Form 1040NR for your non-resident income.

This type of filing is often necessary for foreign nationals who move to the US in the middle of a year or whose Green Card has been revoked. If you’re in this situation, you’ll need to write “Dual-Status Return” at the top of your form and attach a statement showing your income for that part of the year.

You’ll also need to make sure you are not claiming a standard deduction on Form 1040, or that you’re itemizing your deductions. However, you can still claim a dependent as long as they qualify.

It’s important to note that for tax years after December 31, 2017, a non-US citizen or permanent resident cannot claim personal exemptions on Form 1040, unless they are married to a U.S. citizen or resident alien and with their spouse elect, to file a joint return.

Depending on your status, you’ll file Form 1040 as your return and Form 1040NR as your statement (with the corresponding dual-status labels written at the top). If you’re a resident alien at the end of the year, you’ll file Form 1040 as the return and use Form 1040NR as the statement; you’ll write “Dual-Status Statement” at the top of your form.